1st, 2nd, 3rd Mortgages

Mid Island Mortgage provides first mortgages, second mortgages, and third mortgages. We’ll do any purchase deals whether it’s your first or 100th home purchase.

For over thirty-five years, we have been helping you with all of your mortgage needs. Speak with our loan experts today.

Designed to help you gain personalized insight into what home loan works best for you.

Apply with confidence using our secure online application form. It’s fast, simple, and secure!

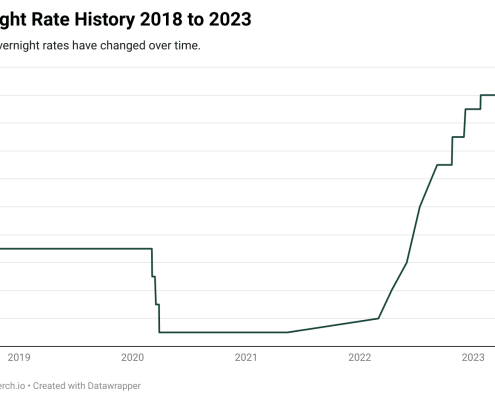

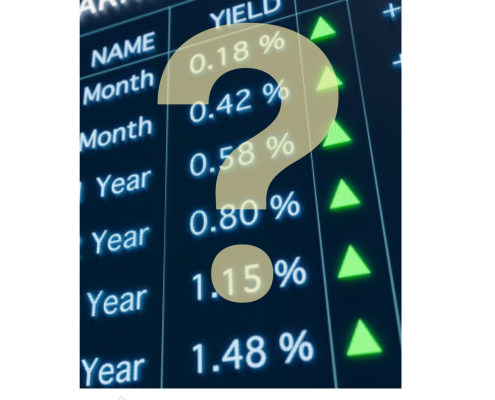

The financial world has it’s own language that can seem daunting. We’re here to help!

Mid Island Mortgage provides first mortgages, second mortgages, and third mortgages. We’ll do any purchase deals whether it’s your first or 100th home purchase.

We work with you before, during, and after the mortgage process to make sure you are satisfied with our services. We work with you to get the best rates and we hold those rates for up to 120 days while you find your dream home.

We get our fees from qualified lenders, not from you – that means we do all the shopping to find you the best rate possible. We do everything in our power to deliver the exceptional service we’ve always been known for—and find new ways to make it better all the time.

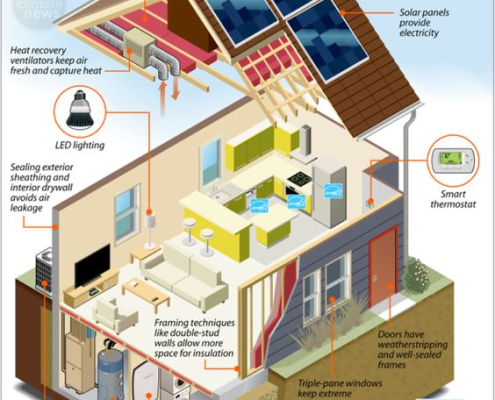

Do you have a big purchase coming up? Or would you like to pay off some of your debts? Ask us about refinancing your home – use the equity you have in your home to help you and your family get ahead in life!

The rules have changed – learn how to buy investment property with 20% money down. We work with you to make sure you are informed and comfortable with the process. We also deal with properties on Gulf Islands that banks won’t finance!

We help first time home buyers understand the mortgage process to help reduce stress. We’re thorough, upfront, and review each step so you won’t be overwhelmed. We are mindful of your needs. We strongly believe that everybody should be treated with equal consideration, care, and courtesy.

Let us introduce ourselves…

Mid Island Mortgage & Savings has been operating in Nanaimo since 1985, and has worked diligently to make sure that everyone walking through our doors receives the best mortgage available. By staying up-to-date with everything going on in the mortgage industry, we can focus on our only goal – providing the best mortgage options to you.

The beginning of a legacy…

John Decker started Mid-Island Mortgage & Savings Ltd. in the early 1980’s with high hopes and big dreams. John had spent numerous years in the financial world before opening up his own company. John helped make Mid-Island Mortgage a recognizable name, and an approachable company servicing his clients needs and wants.

TESTIMONIALS

Dave and I have found your customer service to be friendly and very efficient and we would highly recommend you…

You are so great to work with, thank you! I really appreciate all the info.

Thank you so very much for all your hard work. You most definitely have our recommendation to friends and family.

Thanks Mid Island Mortgage! We’re really excited. Thanks for all your work on this.

We’d love to sit down with you

Financing your home is an incredibly important process. Our dedicated loan experts will earn your trust from start to finish. Come visit us to see how we can help you. Call our office today at 250 753 2242!

Stay up to date

https://www.midislandmortgage.com/wp-content/uploads/2023/04/April-Blog.jpg

788

940

Mid Island Mortgage Brokers

https://www.midislandmortgage.com/wp-content/uploads/2024/08/MidIsland_Logo_Main-Colour-300x217.png

Mid Island Mortgage Brokers2023-12-19 11:04:162024-08-01 17:13:46CEBA Loan Forgiveness: Deadline Approaching

https://www.midislandmortgage.com/wp-content/uploads/2023/04/April-Blog.jpg

788

940

Mid Island Mortgage Brokers

https://www.midislandmortgage.com/wp-content/uploads/2024/08/MidIsland_Logo_Main-Colour-300x217.png

Mid Island Mortgage Brokers2023-12-19 11:04:162024-08-01 17:13:46CEBA Loan Forgiveness: Deadline Approaching

https://www.midislandmortgage.com/wp-content/uploads/2024/08/MidIsland_Logo_Main-Colour-300x217.png

0

0

Mid Island Mortgage Brokers

https://www.midislandmortgage.com/wp-content/uploads/2024/08/MidIsland_Logo_Main-Colour-300x217.png

Mid Island Mortgage Brokers2023-02-07 11:25:342024-08-01 17:15:00Purchase Plus Improvements

https://www.midislandmortgage.com/wp-content/uploads/2024/08/MidIsland_Logo_Main-Colour-300x217.png

0

0

Mid Island Mortgage Brokers

https://www.midislandmortgage.com/wp-content/uploads/2024/08/MidIsland_Logo_Main-Colour-300x217.png

Mid Island Mortgage Brokers2023-02-07 11:25:342024-08-01 17:15:00Purchase Plus Improvements https://www.midislandmortgage.com/wp-content/uploads/2021/10/MIM-OCT-2021-PHOTO.jpeg

867

1280

Mid Island Mortgage Brokers

https://www.midislandmortgage.com/wp-content/uploads/2024/08/MidIsland_Logo_Main-Colour-300x217.png

Mid Island Mortgage Brokers2023-01-03 15:37:152024-08-01 17:15:09Goals Goals Goals

https://www.midislandmortgage.com/wp-content/uploads/2021/10/MIM-OCT-2021-PHOTO.jpeg

867

1280

Mid Island Mortgage Brokers

https://www.midislandmortgage.com/wp-content/uploads/2024/08/MidIsland_Logo_Main-Colour-300x217.png

Mid Island Mortgage Brokers2023-01-03 15:37:152024-08-01 17:15:09Goals Goals Goals

https://www.midislandmortgage.com/wp-content/uploads/2018/06/blog-june-14.jpeg

960

1280

Mid Island Mortgage Brokers

https://www.midislandmortgage.com/wp-content/uploads/2024/08/MidIsland_Logo_Main-Colour-300x217.png

Mid Island Mortgage Brokers2022-10-05 12:13:262022-11-02 15:07:03Fall Update on Mortgage Lending Insights

https://www.midislandmortgage.com/wp-content/uploads/2018/06/blog-june-14.jpeg

960

1280

Mid Island Mortgage Brokers

https://www.midislandmortgage.com/wp-content/uploads/2024/08/MidIsland_Logo_Main-Colour-300x217.png

Mid Island Mortgage Brokers2022-10-05 12:13:262022-11-02 15:07:03Fall Update on Mortgage Lending Insights

https://www.midislandmortgage.com/wp-content/uploads/2017/02/5A3681F2-8BC5-4C96-AB0C-FCA440DF521E.jpeg

636

940

Mid Island Mortgage Brokers

https://www.midislandmortgage.com/wp-content/uploads/2024/08/MidIsland_Logo_Main-Colour-300x217.png

Mid Island Mortgage Brokers2017-06-06 22:46:072021-01-14 15:06:22The Bank of Mom & Dad

https://www.midislandmortgage.com/wp-content/uploads/2017/02/5A3681F2-8BC5-4C96-AB0C-FCA440DF521E.jpeg

636

940

Mid Island Mortgage Brokers

https://www.midislandmortgage.com/wp-content/uploads/2024/08/MidIsland_Logo_Main-Colour-300x217.png

Mid Island Mortgage Brokers2017-06-06 22:46:072021-01-14 15:06:22The Bank of Mom & Dad

#12-327 Prideaux St.

Nanaimo B.C. V9R 2N4

info@midislandmortgage.com

Phone: (250) 753-2242

Fax: (250) 753-2262

Mon - Fri: 9:00 - 5:00

Sat: closed

Sun: closed